nj tax sale certificate premium

Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent. Thats 5000 lien amount 200 4 redemption penalty 1000000 subsequent taxes 240000 24 of subs 17600.

Discretion of tax collector as to sale.

. Purchasers of tax sale certificates in New Jersey buy at their own risk. Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube 2 Ex 99 1 2 Tm2022260d3 Ex99 1 Htm Exhibit 99 1. Once a tax clearance is approved we send the certificate electronically to the municipal clerk where the license is located.

This legislation establishes requirements for publication of notice issuance of notice to the property owner bidder registration conducting the online tax lien sale as. If the tax sale certificate is not redeemed or the. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Statement in certificate of sale. We have 566 municipalities each of which has its own tax sale. This post discusses only those tax sale foreclosures completed by individual non-municipal TSC holders.

Electronic Municipal Tax Sales Online LFN 2018-08 Adoption of NJAC 533-11 creating regulations for long standing PILOT program for internet-based tax sales. What is the risk of purchasing a Tax Sale Certificate in New Jersey. Fill out the ST-3 resale certificate form.

The standard tax sale is held within the current year for delinquent taxes of the prior year. NJ tax liens pay 18 on liens over 1500. Nj tax sale certificate premium Monday February 14 2022 Edit.

The Plaintiff in a tax sale foreclosure must at least 30 days prior to filing its complaint give written notice of its intention to foreclose as well as the amount necessary to redeem. Office of the County Clerk. Taxations Audit branch to administer the Liquor License Clearance program.

New Jersey assesses taxes on the local municipal level. The municipality has to give you back your premium of 1000000. Lands listed for sale.

List of installments not due. Now about 10-20 or so are on line. Once you have that you are eligible to issue a resale certificate.

In order for the winning lien holder to protect their interest in the tax sale certificate it should be recorded in the deed room at the county clerks office within 90 days of the sale. If the interest is bid down to 1 a premium is bid up until the bidding stops to obtain the tax sale certificate. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

The city would auction off that debt and a tax sale certificate would be issued. If you are served with a foreclosure complaint or wish to pursue a claim on a tax sale certificate please call us at 973 890-0004 or e-mail us to see how we can assist you. New Brunswick NJ 08901.

New Jersey State Overview. Ignoring the law may cost. Subject to redemption at a rate of interest less than 1 he may in lieu of any rate of interest to redeem offer a premium over and.

Nj tax sale certificate premium. Real Estate and Tax Law. Municipal charges include but are not limited to.

Wages and hours subject to the New Jersey State Wage Collection Law. The description below is designed to provide the reader with a brief overview of this procedure. Tax Lien Certificates Sec.

Owner Notification Property owners are notified that a lien on their property is up for sale. In order to redeem the lien the property owner must pay the certificate amount plus the redemption penalty and the subsequent tax amount at 24. The ClearanceLicense Verification Unit works with the.

State Alcohol Beverage Commission. The attorneys at McLaughlin Nardi are well versed in tax sale certificate and tax sale foreclosure law. Supreme Court addressed the New Jersey Tax Sale Law NJSA.

Auction starts at 18 and interest rate can be bid down to zero then premium bidding begins. The premium is kept on deposit with the municipality for up to five years. The tax sale certificate that is issued is the detailed receipt of what the lien holder purchased at the tax sale.

Therefore you can complete the ST-3 resale certificate form by providing your New Jersey Sales Tax Permit Number Taxpayer Registration Number. In NJ the lenders policy expense is only a small fee of the owners title insurance premium. County treasurers and tax collectors sell tax lien certificates to the winning bidder at the delinquent property tax sale.

Contracts considered professional service. There are 2 types of tax sales in New Jersey. Tax sale is the enforcement of collections against a property by placing a lien against the property for all outstanding municipal charges due at the end of the calendar year December 30.

Some municipalities include an additional 6 year end penalty on tax lien certificates. Taxations Field Investigations Unit. New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation.

Bidding stops to obtain the tax sale certificate. Bidding down interest rate plus a premium is paid for control of the lien. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax lien certificates greater than 10000 a 6 penalty is added.

Complete a New Jersey Sales and Use Tax Registration. So in the above case we can pretend 10000 in taxes were due to the city. So now there could be a tax sale certificate sale that would place a lien on the house because of a previously held New Jersey Tax Sale Certificate Auction.

As with any governmental activity involving property rights the process is not simple. If you invest in tax sale certificates be mindful of the complexities of the governing state law when you file a bankruptcy proof of claim on account of the certificate. Installments not yet due may be excluded.

After July 1 2017 any applicant for certification that cant obtain a Premier Business Services account may submit a paper application Gtb-10 for business. The procedures that govern tax foreclosure are set down in the Tax Sale Law NJSA. Most auctions are in person call out.

Purchasing a tax sale certificate is a form of investment. Added omitted assessments. The accelerated tax sale is held prior to the end of the year for that years tax delinquencies.

Real Estate Related Services Design De Arte

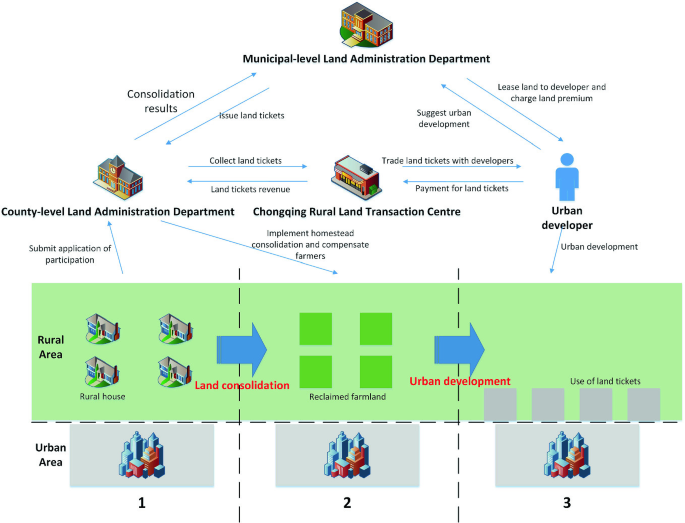

China S Rural Transformation And The Link Policy Springerlink

2018 Audi Q3 Premium Plus Wa1jccfs0jr016387 Bidcars

Trojan Enz 36 Count Lubricated Premium Latex Condoms Bed Bath Beyond

Are You Bidding Premium For Tax Liens Tax Lien Investing Tips

Golden Premium Quality Badges Stock Illustration Download Image Now Istock

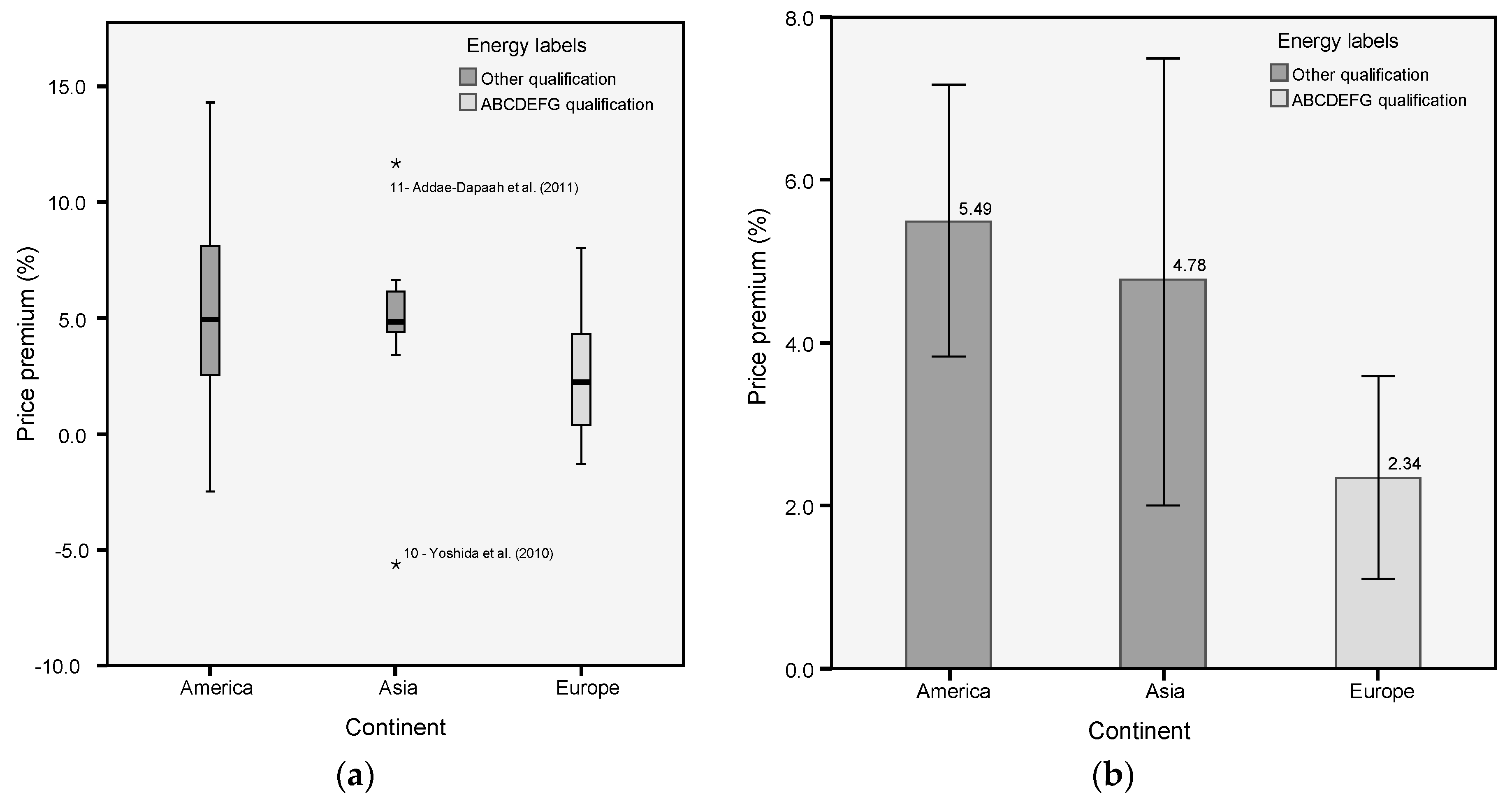

Sustainability Free Full Text Meta Analysis Of Price Premiums In Housing With Energy Performance Certificates Epc Html

Individual Tax Return 1040 Online Esigntax

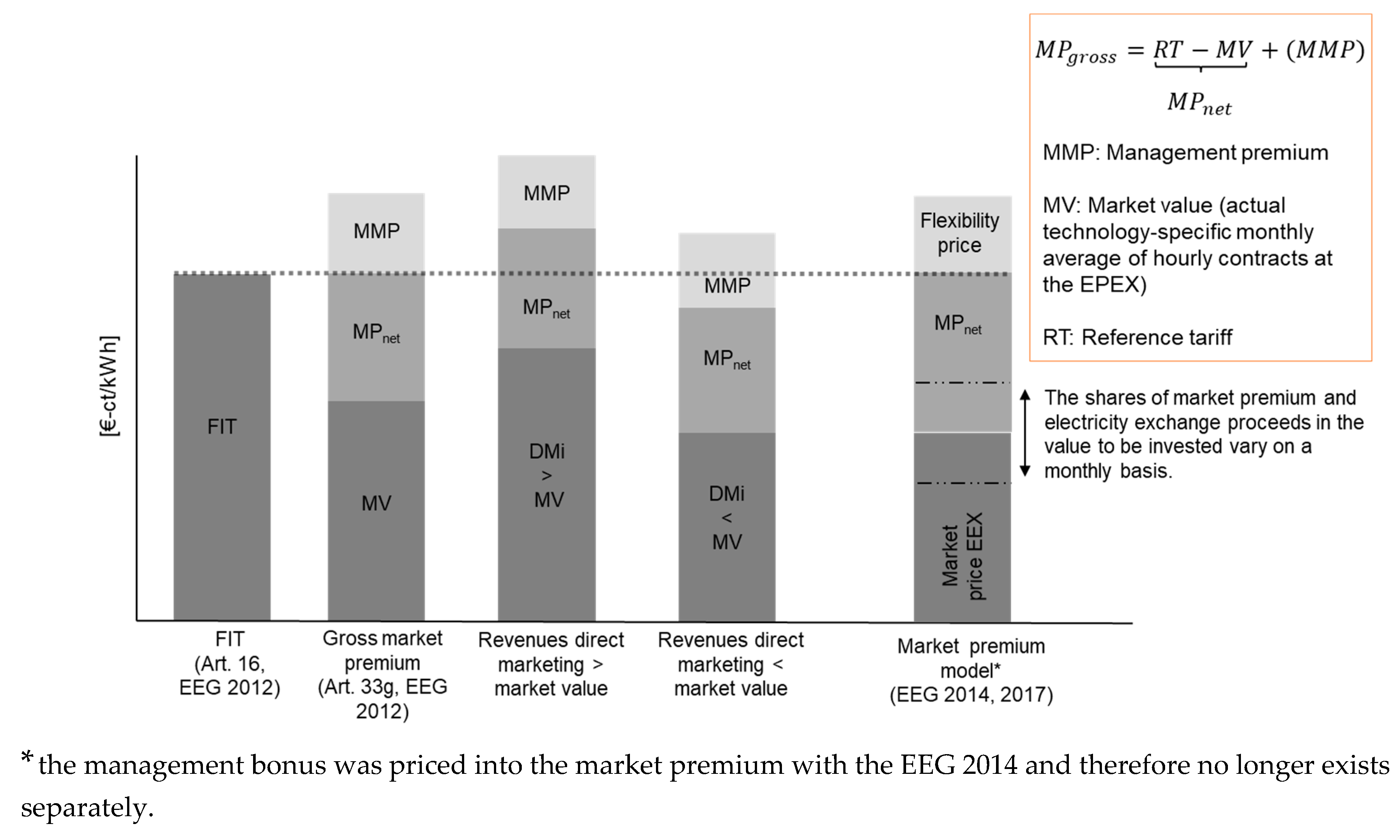

Energies Free Full Text Optimal Timing Of Onshore Wind Repowering In Germany Under Policy Regime Changes A Real Options Analysis Html

Student General Employment Certificate New Printable Sample Settlement Letter Form Credit Dispute Letter Templates Letter Form

Sustainability Free Full Text Meta Analysis Of Price Premiums In Housing With Energy Performance Certificates Epc Html

Grandpa A Sons First Hero A Daughters First Love Love T Shirt T Shirt Shirts

Issuing Bonds At A Discount Or A Premium Video Lesson Transcript Study Com

Tootsie Roll Premium Hot Cocoa Pods For Single Serve Coffee Makers 18 Count Bed Bath Beyond